If you are pursuing a Bachelor of Commerce degree course, there are specific professional courses you should pursue in order to become more marketable. You need to choose a professional course based on your area of specialization.

The major areas of specialization for Bachelor of Commerce students are:

- Entrepreneurial option (ENT)

- Human Resource option (HRM)

- Marketing option (MKT)

- Accounting option (ACC)

- Finance and Banking option (FIN)

- Insurance and Risk Management option (INS)

Accounting and Finance are the most popular areas of specialization while Insurance and Risk Management is the least popular.

Graduating with a Bachelor of Commerce degree without a professional course may work against you in the job market. Since millions are seeking the limited available opportunities, only those with professional courses are given first priority. In order to increase your chances of securing employment, pursue the following professional courses:

- Chartered Financial Analyst

Chartered Financial Analyst is the best professional course for individuals planning to major in Finance and Investment. The course is more powerful than MBA and CPA and it’s a very challenging one.

To qualify for CFA training, you need to possess the following:

- Undergraduate education: A bachelor’s (or equivalent) degree or be in the final year of your bachelor’s degree program (when you register for the Level II exam, you will be required to update your education information), or

- Work experience: Four years of professional work experience (does not have to be investment related), or

- A combination of professional work experience and education that totals at least four years (part-time positions do not qualify, and the four-year total must be accrued prior to enrollment).

CFA takes at least 2 years to complete, there are three levels in total. Many graduates argue that Level1 is the hardest—less than 50% of the students pass annually.

When you are through with CFA, you’ll work for Investment firms, insurance companies, stock market, government institutions, banks and stoke brokers.

Starting salaries for CFA graduates are upwards of $3,000 per month.

- Association of Chartered Certified Accountants(ACCA)

Association of Chartered Certified Accountants is ideal for commerce students specializing in accounting.

The good thing about ACCA is that you don’t have to possess a university qualification; you can pursue even with just a high school certificate.

ACCA Registration requirements:

If you have two A Levels and three GCSEs in five separate subjects including English and maths (or equivalent qualifications), you can start your studies at the ACCA Qualification, which is ranked at Masters level and on completion you’ll become an ACCA member.

The ACCA Qualification is the world leading accountancy qualification for aspiring financial professionals – providing students with the skills, knowledge and values to have successful careers and lead the organisations they work with into the future.

In order to achieve the ACCA Qualification, students have to:

- complete a maximum of 13 exams, depending on prior experience and qualifications

- complete an Ethics and Professional Skills module

- evidence three years of practical work experience within a relevant role.

This means that students can complete the ACCA Qualification in a minimum of three years.

Foundations in Accountancy Qualifications

If you don’t have these qualifications, you can start at our Foundations in Accountancy qualifications and then progress onto the ACCA Qualification if you wish. These awards are broadly equivalent to GCSE level and a degree or HND programme.

When you possess ACCA qualification and a degree in a business related course, your chances of being jobless are minimal.

- Certified Internal Auditor

Chartered Internal Auditor is the best professional course for those specializing in auditing and risk management. Before they settle in the job market, graduates should enroll for this course because it will give them an upper hand over their peers.

Certified Internal Auditor minimum admission requirements:

| ENTRY REQUIREMENTS | | EXIT REQUIREMENTS | |||

| Education | Government Issued ID | Character Reference | | 3 Exams | Experience |

| Master’s Degree (or equivalent) | X | X | | X | 12 months IA experience or equivalent |

| Bachelor’s Degree (or equivalent) | X | X | | X | 24 months IA experience or equivalent |

| Associate’s Degree or three A-Level Certificates – grade C or higher (or equivalent) | X | X | | X | 60 months IA experience of equivalent |

Education

Candidates must hold an Associate’s degree or higher to be approved into one of The IIA’s certification programs. Common equivalents are a Foundation Degree, Diploma of Higher Education, Higher National Diploma,or three A-level certificates with a grade of C or higher are also acceptable.

Acceptable Documents:

- Copy of your degree, official transcripts, or A-level certificates (If your name has changed since you earned your degree, you must also include your legal name change document.)

- Letter from university confirming degree

- Letter from evaluation services confirming degree level

If you have achieved a certificate or qualification outside of the US that is not a formal university degree, but meet degree equivalency standards, you will need to provide an official equivalency report from a credential evaluation service. Please note the report must be in English and cannot be issued by the same governing body that awarded your certificate or qualification. This document should be uploaded within the certification program application process in the educational upload field.

*The IIA has a reciprocity agreement with the AICPA and ACCA. A letter from the issuing body may be accepted.

Character Reference

Candidates must exhibit high moral and professional character and must submit a Character Reference signed by a CIA, CGAP, CCSA, CFSA, CRMA, or the candidate’s supervisor.

Work Experience

Candidates may apply to the certification program and sit for exams prior to obtaining the required work experience. However, candidates will not be certified until the experience requirement is met within the program eligibility period. Experience for the IIA’s certification programs is based on the maximum level of education achieved. The work experience requirements for the CIA program are:

| Education Level | Years of Work Experience Required |

| Master’s Degree (or equivalent) | 12 months – internal auditing experience or its equivalent |

| Bachelor’s Degree (or equivalent) | 24 months – internal auditing experience or its equivalent |

| Associate’s Degree, three A-Level Certificates, grade C or higher (or equivalent) | 60 months – internal auditing experience or its equivalent |

With a qualification in Certified Internal Auditor, you’ll work for any audit firm in the world.

- Certified Fraud Examiner

Certified Fraud Examiner is also another popular professional qualification for auditors. It’s mostly pursued by graduates intending to work for sensitive investigation organizations.

If you want to work for World Bank or IMF, Certified Fraud Examiner is the course to pursue.

Certified Fraud Examiner Admission Requirement:

Open to undergraduate students enrolled in at least nine semester hours (or equivalent*), or graduate students enrolled in at least six semester hours (or equivalent*) in an accredited college or university. Join Now.

*The following organizations are recognized as equivalent college/university qualifying bodies:

Association of Chartered Certified Accountants (ACCA)

Association of International Accountants (AIA)

Chartered Institute of Public Finance and Accountancy (CIPFA)

Institute of Chartered Accountants in England and Wales (ICAEW)

Institute of Chartered Accountants in Ireland (ICAI)

Institute of Chartered Accountants of Scotland (ICAS)

After registering as a member, you are required to undertake examinations. A complete CFE Exam application with documentation is required to take the CFE Exam. The CFE Exam application fee is $400. If you have purchased the CFE Exam Prep Course, the fee is $300.

The CFE Exam tests your knowledge and expertise in the four primary areas of fraud examination: Financial Transactions & Fraud Schemes, Law, Investigation, and Fraud Prevention & Deterrence.

- Certified Public Accountants(CPA)

CPA is suitable for students pursuing Bachelor of Commerce and specializing in Accounting or Finance. This course is best pursued when a student is still in college, after college a graduate may not have enough time to pursue any other studies.

CPA is a popular course for students from other fields like Economics, Statistics, Mathematics and Actuarial Science.

To enroll for this program, you should possess the following qualifications:

- Kenya Certificate of Secondary Education (KCSE) examination with an aggregate average of at least grade C+ (C plus) or its equivalent.

- Kenya Advanced Certificate of Education (KACE) with at least TWO Principal passes provided that the applicant has credits in Mathematics and English at Kenya Certificate of Education (KCE) level or equivalent qualifications.

- kasneb technician, diploma or professional examination certificate.

- A degree from a recognised university.

- International General Certificate of Secondary Education (IGCSE) examination grade C in 6 papers with C in both English and Mathematics.

- Such other certificates or diplomas as may be approved by Kasneb.

CPA comprises of three levels; every student is required to complete all the levels for them to be certified accountants. It’s extremely important for graduates to register with ICPAK after passing Level 3 of CPA.

- Certified Human Resources Professional(CHRP)

Certified Human Resources Professional is a popular certification for business graduates that specialize in HRM.This professional course will supplement your degree and give you an edge over other graduates in your area of specialization.

Requirements for the CHRP designation are:

- Hold an Academic degree,

- At least 2 years work experience in HRM,

- Successful completion of the coursework requirement,

- ِِِِAgree to abide by the Code of Ethics established by the HRMI, and

- Successful completion of the CHRP Exam

It’s highly advisable to pursue this professional course immediately you graduate from college—possessing only one degree is risky.

- Advanced Diploma in Insurance

Advanced Diploma in Insurance is an excellent professional course for Bachelor of Commerce students aiming to work in the insurance and risk sectors.

By pursuing this professional course, you’ll become:

- Chartered Insurer

- Chartered Insurance Broker

- Chartered Insurance Practitioner

- Chartered Insurance Risk Manager

Before you pursue an MBA, first complete this advanced diploma. You may even not find a reason to pursue MBA because Advanced Diploma in Insurance course is very marketable.

- Actuarial Professional Qualification

If you want to work in Actuarial firms, banks, insurance companies and Investment firms, pursue a professional course in Actuarial Science. One of the best institutions to enroll for the course is Society of Actuaries. Though the course may take up to 7 years to complete, your life after school will be smooth. Actuaries are among the highest paid professionals in the world.

- Certified Risk Analysts

Certified Risk Analysts is purely for graduates aiming to work as auditors or for private institutions that deal with risk assessment matters. Insurance companies are the most ideal institutions to work for as a risk analyst.

- Certified Risk Analysts Admission Requirements

he Academy maintains the highest standards in the industry. Here are the requirements.

- ACBSP – Complete exams, courses, degree and specialization from an ACBSP Accredited Business school such as Colorado State University. ACBSP Legal Articulation since 2004

- AACSB – Complete exams, courses, degree and specialization from an AACSB Accredited Business school such as Yale or Harvard or Stanford. AACSB Accreditation Agency since 2003.”

- Complete any Qualifying Masters Degree/Exams in the Relevant Area of Expertise. Example: A Masters in Finance for AFA®, A Masters in Management/MBA for AMC® Certification or a Masters in Project Management for the CIPM® Certification

- Agree to GAFM Ethical Terms.

- Agree to Continuing Education from GAFM MOOC global programs.

- 3 Years of Experience Required.

- or: Complete Program from any GAFM Approved Provider (or any provider formerly known as AAFM or AAPM)

- * Anyone may apply for any certification of GAFM if you have the following: CPA, Accounting Licence, Law Licence, MBA, MS, PhD, DBA, or JD from an accredited school or organization

- Complete a Degree with the AABFS.

- Anyone who completes an Accredited Program MOOC Massive Online Open Course under our Certified MOOC policy.

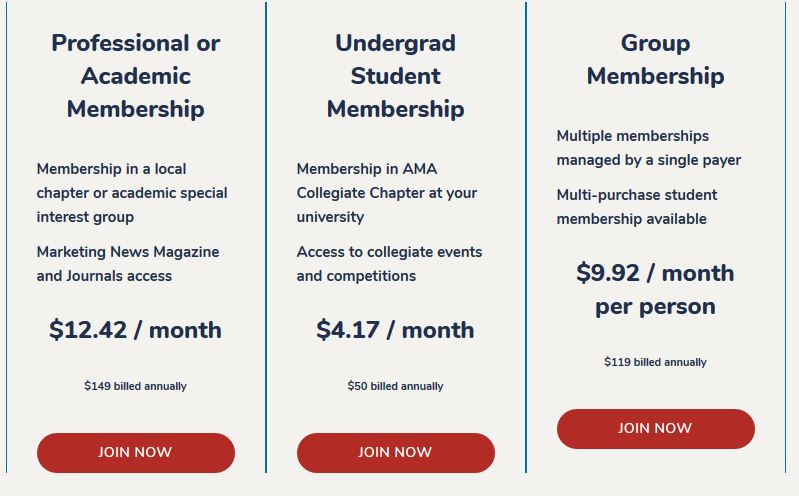

- Professional Certified Marketer

Professional Certified Marketer is ideal for students specializing in marketing. The course is important for students and graduates who need growth in the job market.

The skills you’ll obtain from this career will help you understand the principles of marketing and how you’ll use your knowledge to become an effective entrepreneur.

- Certified Investment and Financial Analysts (CIFA)

Certified Investment and Financial Analysts (CIFA) is almost similar to CFA.The course is offered by KASNEB.If you want to work in banks,stock market,insurance company or any other financial institution that deals with investment,CIFA is the best professional course to pursue.

Academic qualifications

- Kenya Certificate of Secondary Education (KCSE) examination with an aggregate average of at least grade C+ (C plus) or its equivalent.

- Kenya Advanced Certificate of Education (KACE) with at least TWO Principal passes provided that the applicant has credits in Mathematics and English at Kenya Certificate of Education (KCE) level or equivalent qualifications.

- kasneb technician, diploma or professional examination certificate.

- A degree from a recognised university.

- International General Certificate of Secondary Education (IGCSE) examination grade C in 6 papers with C in both English and Mathematics.

- Such other certificates or diplomas as may be approved by kasneb.

From the list provided above,you’ll not lack a suitable professional course to pursue.Good luck!